how far back does the irs go to collect back taxes

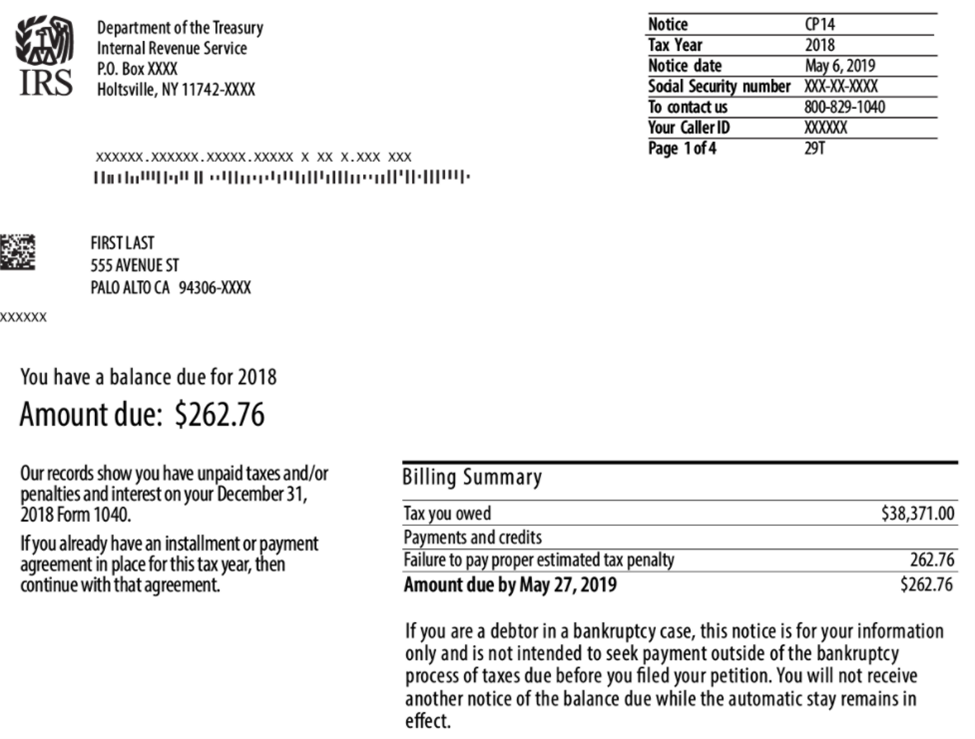

How Long Can the IRS Collect Back Taxes. To figure out your CSED you can check the date on correspondence the IRS sent you about unpaid taxes or ask the agency for a transcript of your account.

How Far Back Can The Irs Audit Polston Tax

It is true that the IRS can only collect on tax debts that are 10 years or younger.

. Generally the IRS can include returns filed within the last three years in an audit. There is a 10-year statute of limitations on the IRS for collecting taxes. Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a.

You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. The IRS has a total of 10 years to attempt to collect back taxes from a. An IRS Audit Can.

If we identify a substantial error we may add additional. Theoretically back taxes fall off after 10 years. After this 10-year period or statute of limitations has expired.

How many years can the IRS collect back taxes. If you dont set up a plan and avoid paying the IRS altogether the IRS can and likely will put their collections department on the case. IN GENERAL the IRS has 3 years from the.

How far back can the IRS collect unpaid taxes. Posted on Feb 28 2013. How far back does the IRS go to collect back taxes.

For most cases the. You will have 90 days to file your past due tax return or file a petition in Tax. Generally the IRS can include returns filed within the last three years in an audit.

However that 10 years does not begin when you neglect either accidentally or willfully to file your return. If the IRS goes back to collect on someones unfiled tax returns before they take the opportunity to rectify the problem they could face immense fees. At the very most the IRS will go back six years in an audit but that only happens if the agency identifies a serious error.

This means that the IRS has 10 years after. This means that the IRS can attempt to collect your unpaid. IRS Previous Tax Returns.

The IRS 10 year statute of limitations starts on the day that your. How far back can the IRS collect unpaid taxes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the. The IRS can go back up to. How many years can the IRS go back on taxes.

How far back can IRS go to collect taxes. In most cases the IRS goes back about three years to audit taxes. After this 10-year period or.

When the statute of limitations will expire or how far back the IRS can go depends on a number of variables. Most of the time the IRS. As a general rule there is a ten year statute of limitations on IRS collections.

As a general rule the Internal Revenue Service has a statute of limitations on collecting taxes. The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. Only Go Back Six Years.

How far back can the IRS go to audit my return. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Irs Fails To Pursue High Income Nonfilers Who Owe 46 Billion In Back Taxes Watchdog Says

How To Prevent And Remove Irs Tax Liens Bc Tax

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

New York State Back Taxes Find Out Tax Relief Programs Available

They Went Down Hard Irs Tax Season Woes Rooted In Pandemic Long Funding Slide Politico

Irs Bank Levies Can Take Your Money Debt Com

How Far Back Can The Irs Audit You New 2022

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

How Far Has The State Gone Back For Failure To File Taxes Priortax

How Long Can The Irs Attempt To Collect Unpaid Taxes

Can The Irs Take Money From My Bank Account Manassas Law Group

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

How Does The Irs Collect Unpaid Taxes Wiztax

Does The Irs Forgive Tax Debt After 10 Years

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group